“The Voice of the Customer (VoC) is a market research technique that produces a detailed set of customer wants and needs, organized into a hierarchical structure, and then prioritized in terms of relative importance and satisfaction with current alternatives.“

The Voice of the Customer (VoC) is not a new concept. In one way or another, it’s been included in quality assurance processes for years, and yet, its full integration in the workflow is a pending tasks for many companies. The Voice of the Customer allows you to listen, interpret and react to what’s being said, and then monitor the impact your actions have over time.

The current challenge companies are facing comes from the volume of data available. In this digital age, feedback is ever-growing and not just limited to the periodic surveys sent to clients. Word-of-mouth has gone digital and has become more relevant than ever: everyone with a Twitter or a Facebook account has an opinion, and more often than not, it’s about the products and services they consume.

A client

As so many other sectors, banking needs to figure out how to translate this first-hand source of knowledge their clients are providing into something useful, something that can be used in the company’s decision-making process.

Voice of the Customer combines two key aspects of information extraction: the need to know in detail what the customer is talking about and to interpret correctly his feelings about it. The former gives a quantitative view of the feedback obtained while the latter gives a more qualitative analysis, measuring what clients think a company is doing right or wrong.

The banking domain has the added difficulty of providing an extremely wide array of products and services, each one of them with very specific subcategories and received through completely different channels.

To illustrate the point, three cases:

- Client A mentions in a periodic satisfaction survey that she is unhappy with the high interest rate associated to her credit card.

- Client B complains through the contact form available on the website about how long he has had to wait on the phone every time he has called the bank’s customer service, even though the people on the other end were very competent.

- A Twitter User comments how right he was to distrust the bank because of the latest fraud case involving members of the board of directors.

Every piece of feedback is directly related to the bank, but other than that, they have very little in common, especially if we think about it in terms of which department would make the most of it.

The first one, Client A, talks about a specific aspect of one of the products the bank offers: interest rates of credit cards; Client B talks about the quality of the client support received, more specifically about the waiting time on the phone and the training of the employees. The Twitter User (who may or may not be a client) comments a recent piece of news that has a direct negative impact on the bank’s reputation.

What we take away from this is the fact that different types of analyses will be necessary in order to extract a complete an accurate picture of what the Voice of the Customer “sounds” like.

360° analysis of the customer

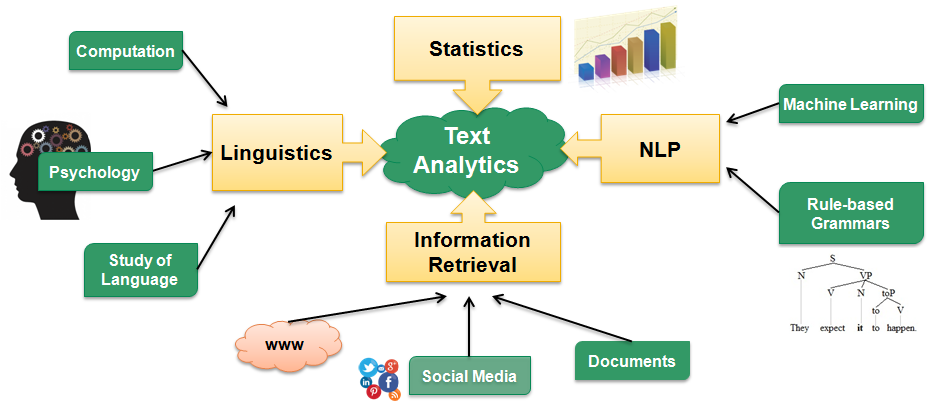

Moreover, to extract the key aspects mentioned before, it is necessary to combine a wide array of text analytics techniques.

Text analytics techniques

Just in the previous examples we would need the following analyses:

- Product and operational activity detection, to analyze if the client is talking about any of the bank’s products or specific aspects or conditions of the product.

- Client A is talking about credit cards and interest rates.

- Channel feedback detection and associated features, to detect those services provided that are not products per se, such as customer support, branches availability, etc., and their different aspects.

- Client B is talking about the call center service received by phone, the training of its employees and the waiting time.

- Domain specific feature-level sentiment

- High rates are negative for credit cards but positive for savings accounts.

- Opposite polarities in the same sentence referring to different features: high waiting time vs. well-prepared operators.

- Reputation analysis takes the point of view of how the feedback reflects on the online reputation of the company.

- The mention of fraud in the news puts the company’s integrity in question.

- Emotional analysis

- Mentions of distrust by the Twitter user.

- Other standard classification criteria: Aaker model, buying signals, customer journey, customer demographics, etc.

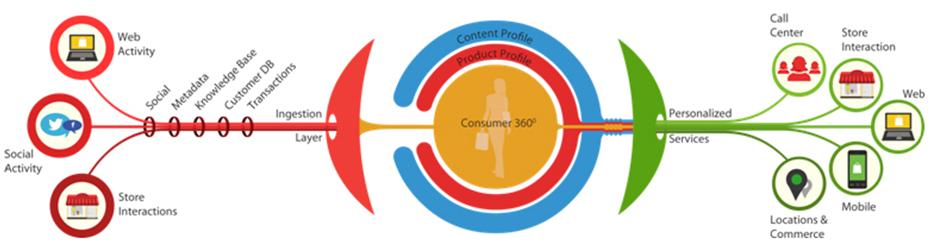

Characterizing all the clients’ feedback according to different criteria is something that will help identify trends and patterns from different points of view, and it will do so with both the information the clients are giving directly, and the feedback obtained from clients and non-clients alike through social media.

Unified feedback and cross-platform analysis

With higher volume of data analyzed comes higher reliability of the results obtained, and the possibility of using this information in many areas: corporate strategy, marketing, quality assurance, customer experience (CX), customer experience management (CEM, CXM), etc.

Including the Voice of the Customer (VoC) in your processes is not only necessary but key to any business, especially now that the volume of data is no longer a hindrance but an advantage.

To learn more about our approach to the Voice of the Customer (VoC), just contact us, either through our support form or by writing us an email to support@meaningcloud.com.

Distill customer insights from interactions with clients

For companies, it is vital to understand the feedback that their customers -current and potential- express through all types of channels and contact points. That is why brands are extending their

Voice of the Customer (VoC) initiatives to a new territory of unsolicited and unstructured content: comments on surveys, call center verbatims, Twitter… Only automatic processing enables to perform this analysis with the the necessary characteristics of quality, volume, response time and homogeneity.