Voice of the Customer (VoC) programs have become an established path for retailers to deliver enhanced customer experiences.

Consumer behavior, nevertheless, is always changing. Retailers are rarely able to anticipate these behavioral changes or adapt quickly enough to preserve or grow their market share.

In 2018, a regional supermarket brand with over 800 hundred stores wanted to understand customer experience at every touchpoint in order to identify potential areas of customer frustration.

The company undertook a strategic Voice of the Customer (VoC) program with the aim of systematically and consistently capturing insights from the customer experience.

The program is still running. It comprises of around 23,000 surveys per month, completed by customers at various branches of the supermarket chain.

In retail, listening to the Voice of the Customer to identify the strengths and weaknesses of business is fundamental. Competition is fierce. Given that the scale of information to be analyzed is immense, the company decided to work with MeaningCloud to process the literal answers to the open-ended questions of the surveys, so they need not worry about the amount or the time needed to process them.

The dashboard of VoC

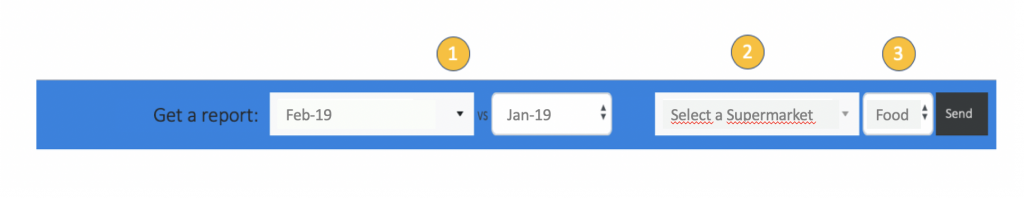

The key elements that define the program of their customized VoC tool are:

- Surveys are analyzed monthly so that they can distinctly see the evolution of the business-relevant issues.

- Results are broken down by supermarket

- Results are broken down according to the different sections of the supermarket:

Geta a report. 1) Select month. 2) Select a supermarket. 3) Select the department

- Food

- Pharmacy, Health & Beauty

- Electronics & Office

- Home, furniture

In addition to that, for every section, there are insights into the following subjects:

- Price

- Customer Service

- Suggestions

- Competitors

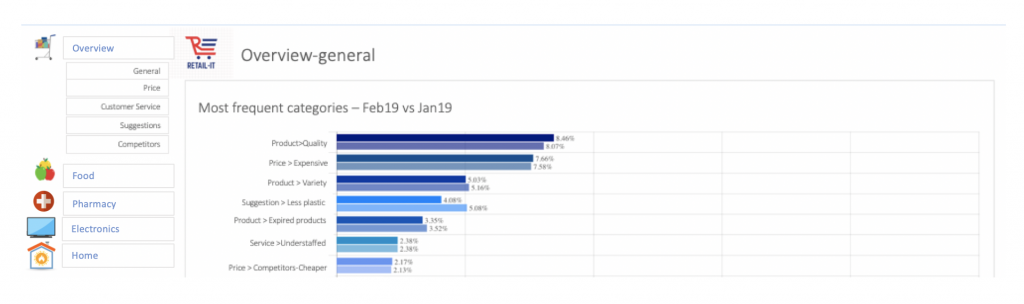

The screen capture below shows the first seven most frequent categories in two months: Feb19 (upper darker bar) and Jan19 (lower lighter bar) for all the sections.

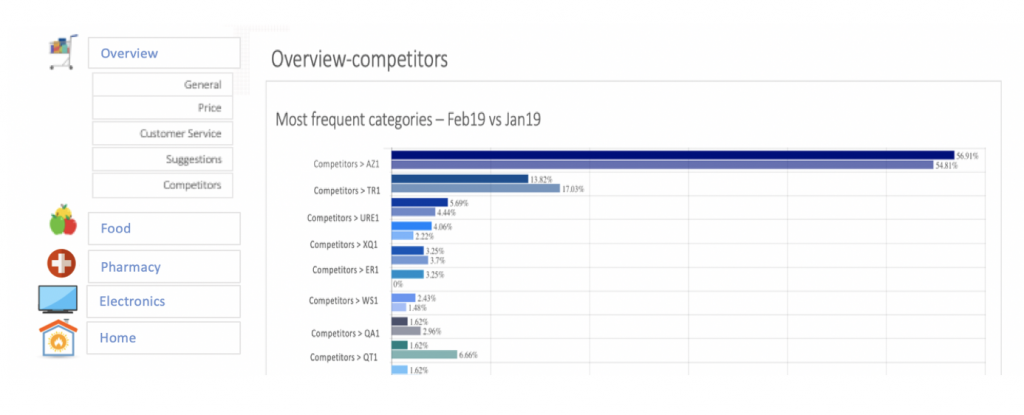

Competitive intelligence

The graph below shows the mentions of each competitor for every section. Competitor mentions for each supermarket domain (such as Electronics) ensue as the most valuable source of competitive intelligence for the company.

What about being plastic bag-free?

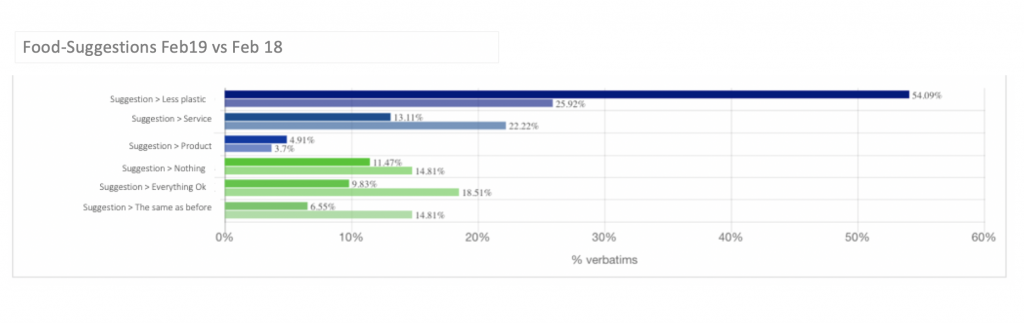

An example of the insights they gather from their monthly surveys are suggestions provided by customers. The VoC dashboard allows the company to witness the ever-increasing awareness regarding the environmental impact and hazard of the single-use plastic bag.

See, for example, the evolution of suggestions concerning the eradication of plastic bags from Jan-18 to Jan-19. The graph shows the results for the Food division.

Voice of the Customer in Retail Demo

At MeaningCloud, we know how crucial unstructured data is for the Voice of the Customer analysis , so we’ve defined a model focused on the retail domain that will allow you to characterize in detail any feedback from your customers, enabling you to carry out an in-depth analysis to identify the customer’s wants and needs in an organized way.